Norwegian craft beer 2014

Norwegian craft beer |

It's time for the annual statistics post where we look at the development of Norwegian craft brewing in numbers. Unfortunately, unlike in the US, the Norwegian brewer's association does not produce official statistics, so complete sales figures are not available, but there are a few useful figures we can look at instead.

In Norway, the government monopoly Vinmonopolet owns the only shops allowed to sell alcohol stronger than 4.75%. They release annual sales statistics, and their statistics have shown beer sales rising for several years now. However, every year, the best-selling beer is the same strong pale lager, so the raw figures don't tell us very much about the craft segment.

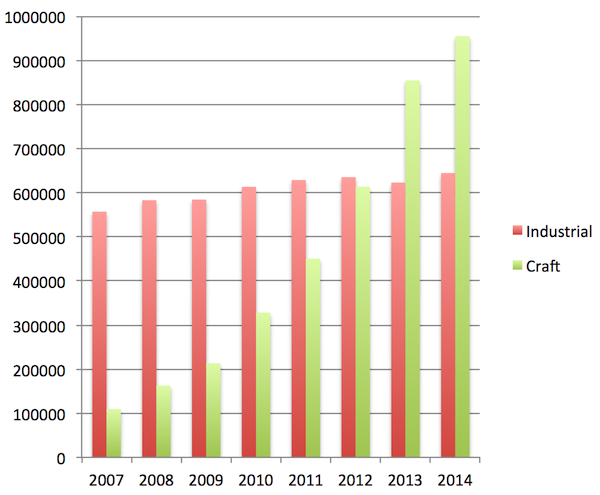

Therefore, I manually classify the beers on the list of the top-selling 200 beers into craft or industrial. I've included the "crafty" offerings of the industrial brewers in the craft segment. Doing that, we get the figures in the diagram below. The first thing you see in the that diagram is that craft and industrial are two completely different categories, as different as beer and wine, at least in terms of sales.

Wine monopoly beer sales |

As you can see, the rise in craft beer sales continues. It was 644k liters in 2013, against 955k in 2014. The diagram makes it seem as if growth is levelling off, but remember that these figures are based only on the best-selling 200 beers. As the selection of the monopoly keeps improving, the share of the top 200 keeps shrinking. In 2013 the top 200 made up 82% of sales, but in 2014 they only made up the top 73%. If we assume all of the sales below the top 200 was craft we get 1.1M liters in 2013 and 1.5M liters in 2014. That's pretty dramatic growth, but probably not accurate. Anyway, sales of craft beer are now more than 9 times what they were in 2007, so growth really has been dramatic.

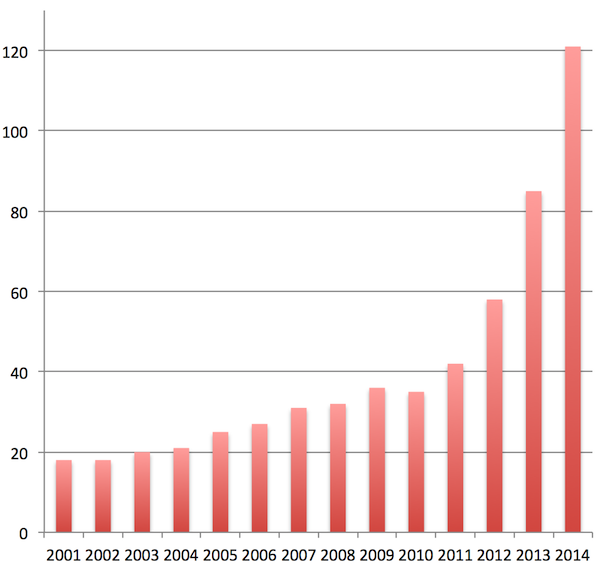

If we look at the supply side, the number of breweries is also up, as you can see in the figure below.

Number of breweries in Norway |

We're now at an astonishing 121 Norwegian breweries, up from 85 in 2013, and 58 in 2012. I'll say that again: the number of breweries is now double what it was two years ago. That's fairly dramatic, and I am not sure that the Norwegian market can support this many breweries. Up to two years ago, all the breweries were saying the same thing: they couldn't produce enough to keep up with demand. I don't seem to hear that as much any more, so it's possible that we are reaching saturation point, and that the weaker breweries will start dropping off. Maybe. So far there's no sign of that in the numbers.

(I'm using my own list of breweries with year of startup and closure in order to produce the figures above. I lean heavily on Ratebeer to keep the list updated.)

Knut Albert has looked at the likely development in 2015 and his estimate is that another 50 breweries will open in 2015. That would mean that growth will continue at a similar pace through the next year as well. As far as I can tell his projection looks correct. If that happens I really don't know how they will all sell their beer. Surely there has to be a limit to demand somewhere?

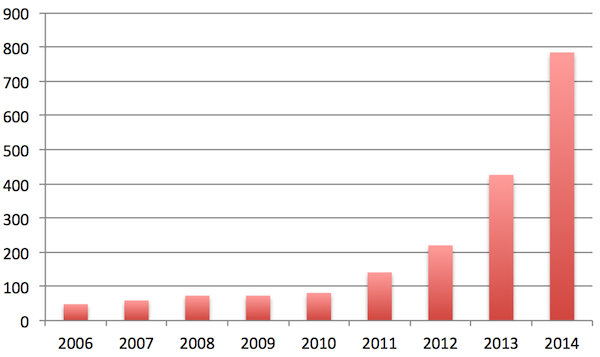

The figures for new Norwegian beers in 2014 are similar. Keeping a list of these is a decidedly non-trivial job, so I've used the list that Ratebeer admin Yngvar Ørebek maintains to produce the diagram below.

New Norwegian beers per year |

As you can see, growth is exponential here, too. In 2013 we had 426 new beers, which I thought was crazy. In 2014 there were 826 new beers, which ... quite frankly I never thought I'd see. Denmark used to be far, far ahead of Norway here, but with 756 new beers in 2012, and 927 in 2013 they are no longer that far ahead. Denmark kind of plateaued at 506 in 2006 and growth has been sort of slow after that. If Knut Albert is right about the number of new breweries we may well beat the Danes in 2015.

In beer terms Norway is now a completely different place from the dreary lager desert of a decade ago. Growth has been unbelievable, but I'm now beginning to wonder how much longer it can continue. It should be noted that a major driver for the Norwegian economy is the oil price, which has been halved over the past 6 months, leading to the beginnings of a downturn in the oil industry and supporting industries. So next year a record number of brewers will very likely be competing in an economy that's more strained than we've seen in a while. That could get interesting.

It doesn't seem too much of a stretch to assume that in the near future, new breweries will have to find some way to distinguish themselves from their competetion. Drawing on the local farmhouse tradition would seem to be an obvious way to do that. It remains to be seen if anyone actually will.

Similar posts

Norwegian craft beer 2012

A year ago I posted an analysis of craft beer in Norway, where I concluded that craft beer had taken off in Norway, and that the growth would continue in 2012

Read | 2013-01-20 17:32

Norwegian craft beer 2013

The Norwegian government alcohol monopoly, called Vinmonopolet in Norwegian (literally the Wine Monopoly) has released sales figures for 2013, so I thought I'd carry on my series of blog posts analyzing their sales figures

Read | 2014-03-29 14:51

Norwegian craft beer production

Following my analysis of the Norwegian craft beer market some people were wondering what the graph of total craft brewery output would look like

Read | 2013-02-17 11:14

Comments

No comments.