Why Nations Fail — a review

Cover |

Kapuscinski once wrote of a road trip to Onitsha, a market town in Nigeria famous for the special brand of literature sold in the market there. His essay, however, is not so much about Onitsha, as about a hole in the road. The road through Onitsha was not a good one, and inside the city itself it turns rather muddy, with a giant hole in the mud. Cars struggle to get through the hole, and long queues have formed around it in both directions.

What is remarkable is that since it's inside the town, the hole has given rise to a whole little economy of its own. You can buy food and drinks while waiting in the queue, you can have your car repaired, you can pay to have teams of people help you get the car through, and so on and so forth. There were even little hotels.

The question that's clearly on Kapuscinski's mind is: if Africans can conjure whole cottage industries out of literally nothing more than a hole in the ground, how can Africa be so poor? The problem cannot be that Africans are lazy, or stupid, or that they don't have entrepreneurial instincts. What, then? To his credit, Kapuscinski does not pretend to have an answer.

While they don't phrase the question in quite this way, economists Daron Acemoglu and James Robinson do in fact claim to provide an answer in their book "Why Nations Fail". And while the title is rather tabloid, the book is anything but. The authors are very highly respected economists (Acemoglu is the 6th most cited economist in the world), and the book is the summary of 15 years of research. Which shows quite clearly.

I decided to read this book after seeing an interview with Daron Acemoglu where he was asked whether the greed of bankers was the main cause of the financial crisis. Acemoglu dismissed this very common notion by saying that greed is human nature, there's nothing new or surprising in it. Nor can we change human nature. This is why we have institutions, he said. They exist to protect society from the greed and other failings of individuals. Now this guy is worth watching, was my reaction. Very, very rarely does someone answer a popular conundrum so clearly and so obviously correctly that it turns your own opinion around.

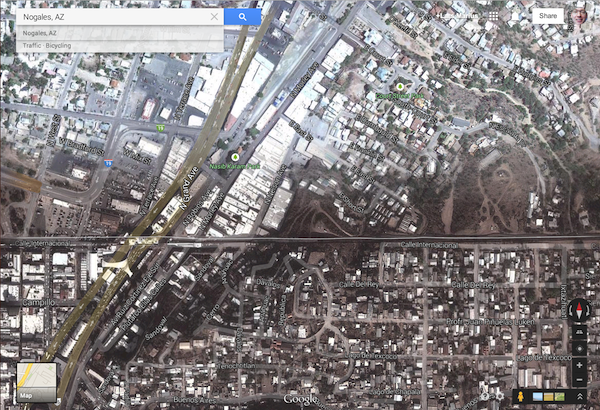

The book opens with a small illustration of their thesis, by looking at the town of Nogales, cut in two by the US-Mexico border. North of the security fence, Nogales is a prosperous American town much like any other. Just meters away, south of the fence, Nogales is a run-down, ramshackle dust town of poor housing, unreliable electricity and sewers, much less wealthy, and with much higher criminality. The difference is, in fact, so stark that it's clearly visible in satellite photos.

Satellite imagery of Nogales, from Google Maps |

How can this be? The towns are literally one, divided by a fence. The climate is the same, the culture is the same, the genes are the same. Even the people are to some extent the same, as many have moved from south of the fence to north of it. So, again, what? Acemoglu and Robinson's answer is institutions. People south of the fence have organized themselves differently from the people north of it, and this has profound consequences for society and the economy.

Let's say that you live south of the border, and, dissatisfied with poor mobile phone service, you decide to start a mobile phone company. This, as it happens, will run into serious legal difficulties, because the richest man in Mexico, Carlos Slim, has such good contacts with government that he's legally protected against competition. Obviously this will do nothing to help economic development, and indeed the OECD has estimated the cost of Slim's monopolies to Mexican society at 129 billion USD over four years. Multiply this effect across most sectors of the economy, and what you get is a poor country.

The other aspect of the institutional problem is perhaps best illustrated by Russia. Recently, the New York Times published an article on how people who start their own business are more likely to go to jail than common criminals are. Why? Because when you build something that succeeds in Russia, people better politically connected than you will try to take it away from you. And because the system is totally rotten, quite often they succeed. Again, this does nothing to help economic development. Under a system like this, Steve Jobs would not start a business, and even if he did he couldn't keep it.

The big question, of course, is how do countries end up like this? The authors answer this by pointing out the link between political and economic institutions. That is, whoever has political power can shape economic institutions, and generally they do it in a way that benefits them and their political power base. In Egypt, society rests on the army, and unsurprisingly it turns out the army runs substantial sections of the economy. Conversely, in democracies where power is broadly based, the economy is set up in a way that benefits most people.

Memorial to a failed state, VDNKh, Moscow |

The authors use the terminology of inclusive versus extractive institutions, both economic and political. This gives four possible states for each country, but according to Acemoglu and Robinson only two states are stable: those where both economic and political institutions are either extractive or inclusive. In the other two states, those who wield political power will reform economic institutions to their own benefit. In the case of inclusive political institutions, those who benefit is everyone.

Once you've read the book and internalized the logic behind Acemoglu and Robinson's thesis, you'll find that it's pretty easy to predict a number of key facts about countries around the world. In any country where political power is concentrated in the hands of a small group, you'll find that the economy is generally set up to benefit the same group. You'll also find that economic growth is generally lacklustre, because these people protect their own economic interests by limiting competition and avoiding the kind of disruptive change that brings economic growth.

The authors have worked on this thesis for more than a decade and a half, and the book contains detailed historical argumentation to show how political and economic institutions evolve in tandem, but very, very slowly. Real change can take centuries, and effects from the past stay with countries and regions for a long, long time. This is a somewhat disheartening message, since it pretty much discounts the effectiveness of development aid and other simple solutions. However, as Peter Hammill said, "It's a sad philosophy, but better sad than wrong."

The full theory is obviously more complex, and far more subtle than what I've been able to describe here, and in fact the argumentation for the thesis is almost as interesting, and easily worth reading the book for in its own right. It's very highly recommended. I wouldn't hesitate to describe it as one of the most interesting books I've ever read.

Remains of a failed state, Chufut-Kale, Ukraine |

Similar posts

Bitcoin: promises and problems

Following on from my explanation of how Bitcoin works I wanted to go deeper into to what degree it works as promised, and what its future is likely to be

Read | 2013-06-23 17:18

The price of ale

One thing that struck me very strongly when I was on the Toer de Geuze in 2012 was that the pricing for beer was totally wrong, and that major changes would have to be on the way

Read | 2014-06-16 19:14

Isola della Birra

We went to Milan on a weekend trip to visit my youngest sister

Read | 2007-12-16 15:17

Comments

No comments.